A mortgage scheme designed to increase the number of deals available to homebuyers with a low deposit or limited equity is running until mid-2025. Several major lenders are taking part in the Government’s mortgage guarantee scheme, where want-to-be homeowners have access to 95% mortgages. However these are not special mortgages and they’re certainly not the cheapest – here’s what you need to know.

Read MoreAuthor: interestratesinfo

Three UK banks announce cuts to cost of fixed-rate mortgages

Three UK banks have announced cuts to the cost of fixed-rate mortgages, reversing some of the price rises seen in recent weeks.

Barclays Bank has announced it will reduce the price of five-year fixed-rate deals for new borrowers and remortgagors by up to 0.45 percentage points from Friday. Its five-year fixed-rate for borrowers with a 40% deposit is decreasing from 4.47% to 4.34%.

At HSBC there will be cuts to two-, three- and five-year home loans, and the bank has withdrawn the 10-year fixed-rate mortgages it offers to remortgage customers.

TSB will also make changes on Friday, and cut two- and five-year deals for house purchases by up to 0.10%.

In recent weeks lenders had been increasing the price of mortgages as the prospect of a spring interest rate cut from the Bank of England receded.

However, money market “swap rates” on which most fixed-rate deals are based have started to fall this week.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “This latest round of mortgage rate reductions from some big lenders is great news for borrowers.

“They come on the back of a decline in swap rates, which underpin the pricing of fixed-rate mortgages, over the past week.

Read MoreIt is time to loosen lending policies and truly help buyers – Bamford

Support for the housing market, particularly in terms of support for homebuyers, often tends to be couched in terms of stamp duty reform or, more recently, a replacement for Help to Buy, or a further extension of the government’s mortgage guarantee scheme.

However, you might well argue that for certain borrower demographics – perhaps first-time buyers – this feels a little like tinkering around the edges, although who wouldn’t want to see more affordable housing built, particularly in the house price, wage and rental environment we currently have?

Clearly, there remain some – often insurmountable – hurdles for would-be first-time buyers, not least in terms of their ability to get on the ladder, especially if they don’t have the support of parents or grandparents, or if they want to own a home in fewer than five years.

Read MoreMortgage lending caps now well below average house price

The Bank of England says one in four mortgages will end when the mortgage borrower is in retirement, as more people extend mortgage terms to make repayments more affordable.

The Bank says over half (51%) of mortgage borrowers now opt for a 30-year mortgage or longer, while between 2021 and 2023, the average mortgage term length for a first-time buyer increased by a year, from 28 years to 29.

Remortgaging has seen the biggest increase in average term length: in 2021 the average mortgage term for remortgaging was 21 years, whereas by 2023, the average mortgage term for remortgaging increased to 23 years, an increase of two years.

The average property now costs seven times the average person’s salary. This is significantly higher than the four-to-five times salary cap that many mortgage lenders use as a guideline.

Read MoreCould higher rates still deliver a mortgage crisis?

Since mortgage rates began rising, many of the nine million mortgaged households in the UK and close to two million landlords have been faced with the prospect of much higher payments.

Many had become accustomed to ultra-low interest rates for more than a decade.

In this six-part series, we look at how much more people are really paying when they take out a new mortgage, how households are coping and if a mortgage crisis is afoot.

Here we look at whether a mortgage crisis could still unfold over the coming months and years.

Read MoreLeasehold reforms may open up Govt to £30bn legal challenge

Leasehold reforms making their way through parliament may subject the next government to a “colossal” £30bn black hole if passed, according to the Residential Freehold Association.

The freeholders trade body has written the UK’s finances watchdog, the Office for Budget Responsibility, to warn that the Bill’s plans to cap ground rent and regulate service charges could leave the government open to huge compensation claims.

It says the moves “would fundamentally rewrite millions of long-term standard leasehold contracts relied upon by investors such as pensioners, charities and other major institutions”.

This would “inevitably” lead to a legal challenge under Article 1 of Protocol 1 of the European Convention on Human Rights, the association says.

The Leasehold and Freehold Reform Bill, introduced last November by housing secretary Michael Gove, plans to boost the rights of people who live in the 4.77 million leasehold homes in England, which accounts for 19% of the nation’s housing stock.

Read MoreWhat mortgage is better? A two- or five-year fixed rate?

Are you torn between taking out a two-year fixed rate mortgage or a five year fix? If so, you have come to the right place.

This is a question which many-a would-be buyer and remortgaging homeowner is pondering at the moment and it’s no wonder.

As you will no doubt be aware – it’s a bit of a conundrum.

Here’s the problem. A two-year fix is more expensive – new data out just this week from Moneyfacts shows the average two-year fixed rate is 5.91% whilst the five-year version is 5.48%. The cost difference in repayments for the two can amount to hundreds of pounds.

But whilst you will pay more to fix for two years, with predictions interest rates might fall later this year, would the cheaper five-year option confine you for the long haul, and prevent you benefiting from even lower rates in the future?

Read MoreMortgage News: NatWest, Santander Raise Rates As MPowered Takes Opposing View

NatWest is increasing the cost of selected two and five-year fixed-rate residential mortgages by 0.05 percentage points. The increase will be applied on deals for home purchase, including first-time buyer rates, and for remortgage, effective tomorrow (Wednesday).

The move comes despite falls in wholesale interbank borrowing rates, which suggests NatWest is attempting to control demand for its products so as to be able to maintain service standards, and not responding to fears that borrowing costs generally are set to remain high.

There is a growing expectation that the Bank of England will trim the Bank Rate from 5.25% at some point over the summer.

NatWest already increased rates for new borrowers in April and hiked the cost of product transfer deals (available to existing customers coming to the end of a deal and looking for a new rate) on 8 May.

Its two-year fixed rate for home purchase will now increase from 4.77% to 4.82% (60% LTV) with a £1,495 fee. The five-year equivalent rises from 4.4% to 4.45%.

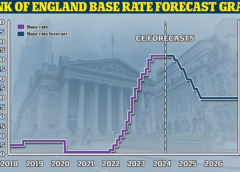

Read MoreWhen will interest rates fall? Forecasts on when base rate will be cut

The Bank of England is likely to make its first cut to base rate in summer, according to the latest forecasts.

This week, the UK’s central bank opted once again to hold the base rate at 5.25 per cent, marking its sixth pause in a row.

It means the base rate has been stuck at its current level since August last year.

Economists are now divided on how far rates will fall in the second half of this year.

Base rate could fall as far as 4 per cent by the end of this year, according to the latest forecasts from Capital Economics.

Others forecast just one or two cuts from the current 5.25 per cent level to 4.75 per cent by the end of this year with the first coming in either June or August.

Read MoreIncrease in older buyers searching for first home: Legal & General

There has been a growth of older first-time buyers, increases in average loan sizes, and longer mortgage terms being searched for, the latest data from Legal & General Mortgage Services reveals.

It found there was a 13% increase in 56 to 65-year-olds searching for their first property in Q1 2024 compared to the same period last year suggesting that a growing number of buyers are having to wait until their late 50s and beyond to take their first step onto the housing ladder.

Legal & General’s data platform Ignite found in the 12 months to April 2024, 38% of potential buyers in the UK were first-time buyers (FTBs), with an average age of 33.

When comparing Q1 2024 and Q4 2023, there was a 37% increase in 18 to 30-year-old FTBs searching for a property, and a 33% increase in 31 to 40-year-old FTBs.

Read More