More than 2,000 households a month are facing homelessness in England because private landlords say they are selling up, with some blaming uncertainty caused by government delays to renting reforms.

Official figures show that more than four in 10 families who have asked councils for temporary housing after a private landlord ended their tenancy are in the predicament because the owner told them they were putting the property on the market.

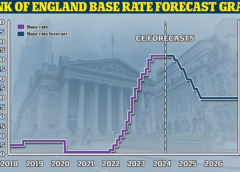

Meanwhile, almost a third of landlords plan to reduce their rental portfolios and only 9% say they likely to grow them, a survey by the National Residential Landlords Association (NRLA) found. Stubbornly high interest rates are another key cause of sales, the association said.

Recent data showed that the number of children living in temporary accommodation in England had hit 145,800, a record high and up 12% in a year. The homelessness charity Riverside said this was evidence of a “humanitarian crisis unfolding behind closed doors in towns and cities across England”.

Read More