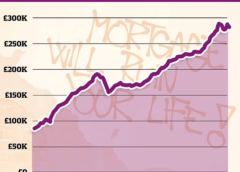

Homeowners coming off fixed rate mortgages faced huge rises in their monthly payments, latest figures have revealed, with the costs severely biting into household disposable income.

With the Bank of England base rate rising to 5.25 per cent in the summer of last year, families faced soaring mortgage rates with the average two-year fixed rate reaching 6.9 per cent.

The new rates meant many homeowners, especially those with large mortgages still to pay, faced challenging increases in monthly payments.

Last year, more than 1.4m households in the UK had fixed rate mortgage up for renewal, with more than half coming off rates of less than two per cent.

Ken James, director at Contractor Mortgage Services, told The Independent that the change in payments meant some were forced to either extend their mortgages or even sell up and move elsewhere.

“And while they may have had money in previous years for a holiday or a new car, they are now having to hold back as their monthly mortgage payments rise,” he added.

The Office for National Statistics has published estimates on the impact of the rising mortgage rates for those impacted in 2023, breaking the figures down by region to calculate which areas were most exposed.

Read More