ome of the UK’s biggest banks are raising mortgage rates as expectations of when the Bank of England will cut interest rates are pushed back.

Barclays, HSBC and NatWest are all increasing some costs on fixed-rate mortgage deals from Tuesday.

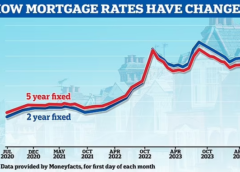

Mortgage rates have risen over the past few weeks as views have changed on when the Bank might cut borrowing costs.

The Bank is now not expected to cut its benchmark rate as early or as often as previously thought.

The announcement from Barclays, which is lifting rates for the second time in the space of seven days, will see a 0.1% increase across a range of its mortgage products.

NatWest said it would raise some of its two and five-year “switcher” deals for existing customers by 0.1%.

HSBC added it was increasing some of its rates on Tuesday, but did not give details of the increases.

Read More