Mortgage rate rises in the UK are easing in an “encouraging sign” for homeowners, according to experts.

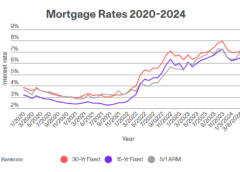

The average interest rates on overall two and five-year fixed deals rose from March to April but more modestly than the month before, according to research by Moneyfactscompare.

Despite this slight hike, this mortgage rate rise remains lower compared to the average reported for January 2024.

Between the beginning of March to early April, overall average two and five year fixed rate mortgages jumped to 5.80 per cent 5.39 per cent, respectively.

Currently, the average two-year rate deal is higher 0.41 per cent than the five-year equivalent, Moneyfacts found.

As well as this, the average standard variable rate (SVR) remained at 8.18 per cent which is just below the highest recorded between November and December 2023.

Read More