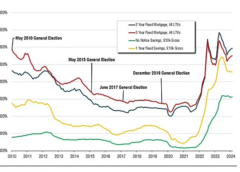

Homeowners are warned that if the Conservatives get elected in the upcoming General Election, there could be a “second mortgage bombshell” on the way.

Britons could face £4,800 in extra mortgage payments over the five years they are elected.

Rishi Sunak announced a £17.2billion package of tax cuts, including a further 2p reduction in employees’ national insurance on Tuesday.

However, Reeves said Labour’s analysis suggested the Tory plans required an extra £17.4billion of borrowing in 2029-30, and a total of £71billion over the whole five-year period.

The Shadow Chancellor has alleged that the Conservative manifesto contains £71billion of unfunded commitments and could result in “a second Tory mortgage bombshell” as the parties continue to clash over tax and spending.

If the Conservatives borrow this amount, it could result in the Bank of England putting up interest rates by 56 basis points.

This means that someone with an 85 per cent mortgage on the average house in England risks facing £4,800 in extra mortgage payments over the five years if Conservatives are elected she explained.

Read More